Mission

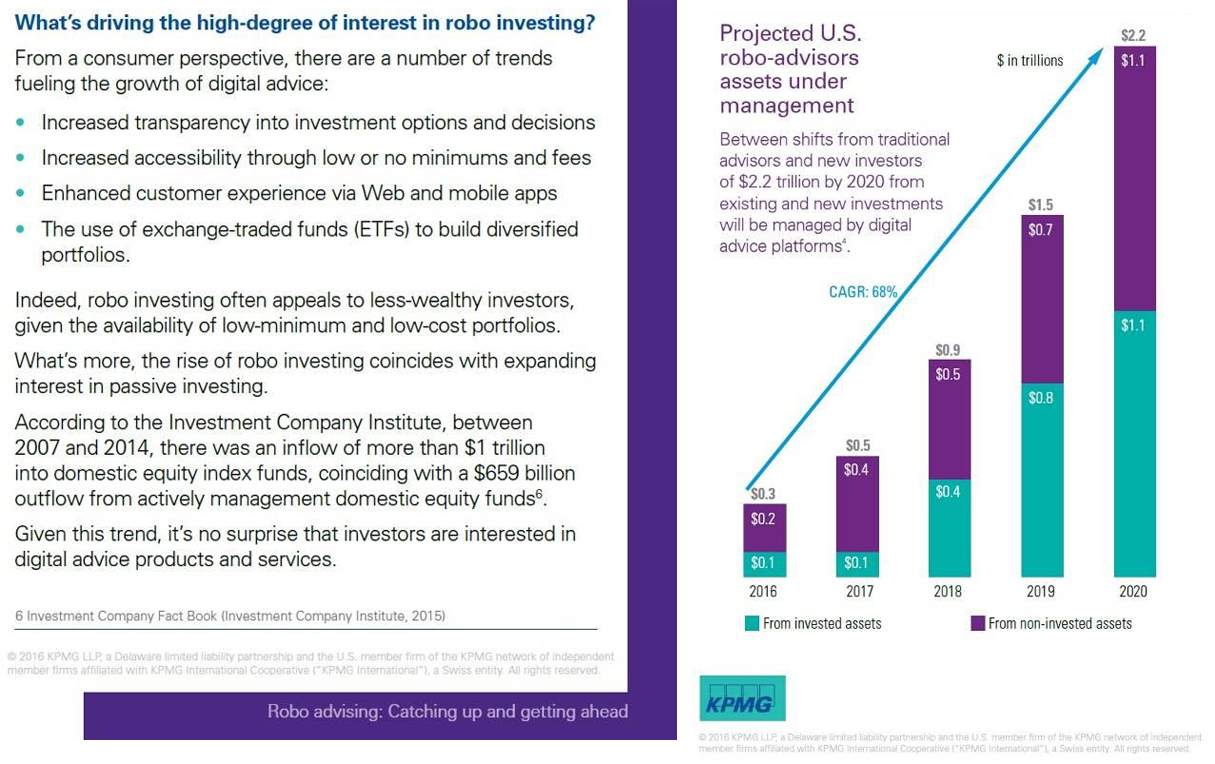

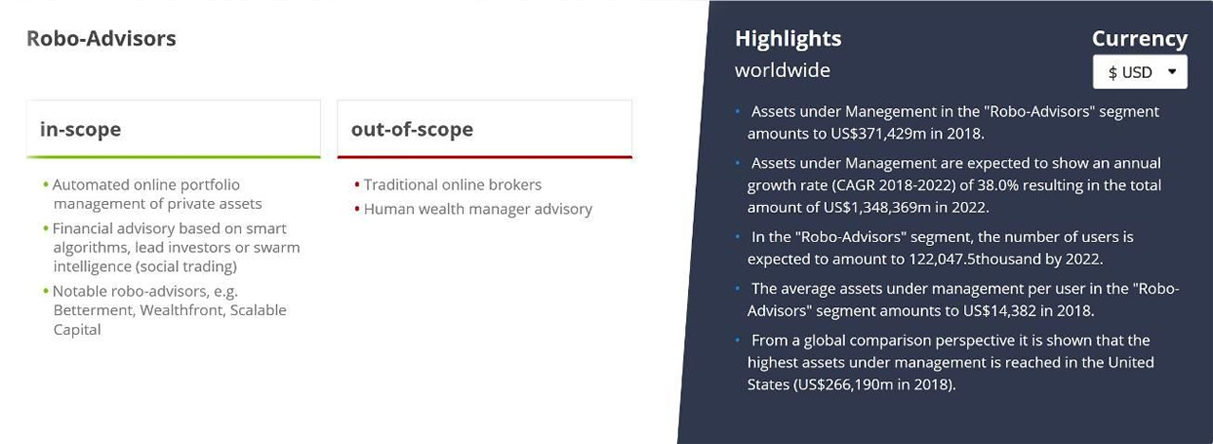

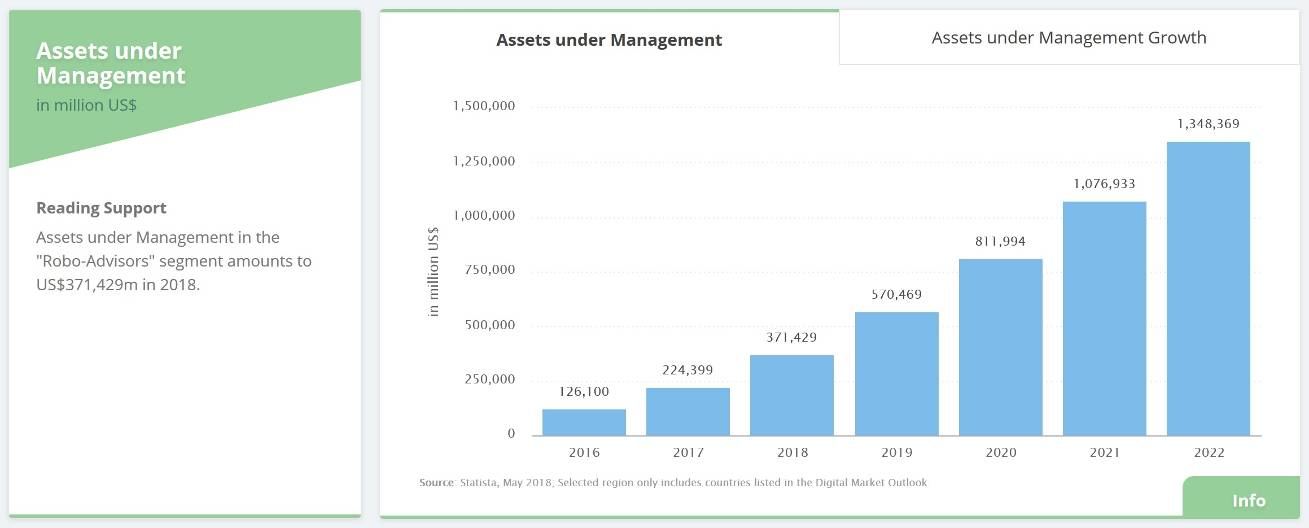

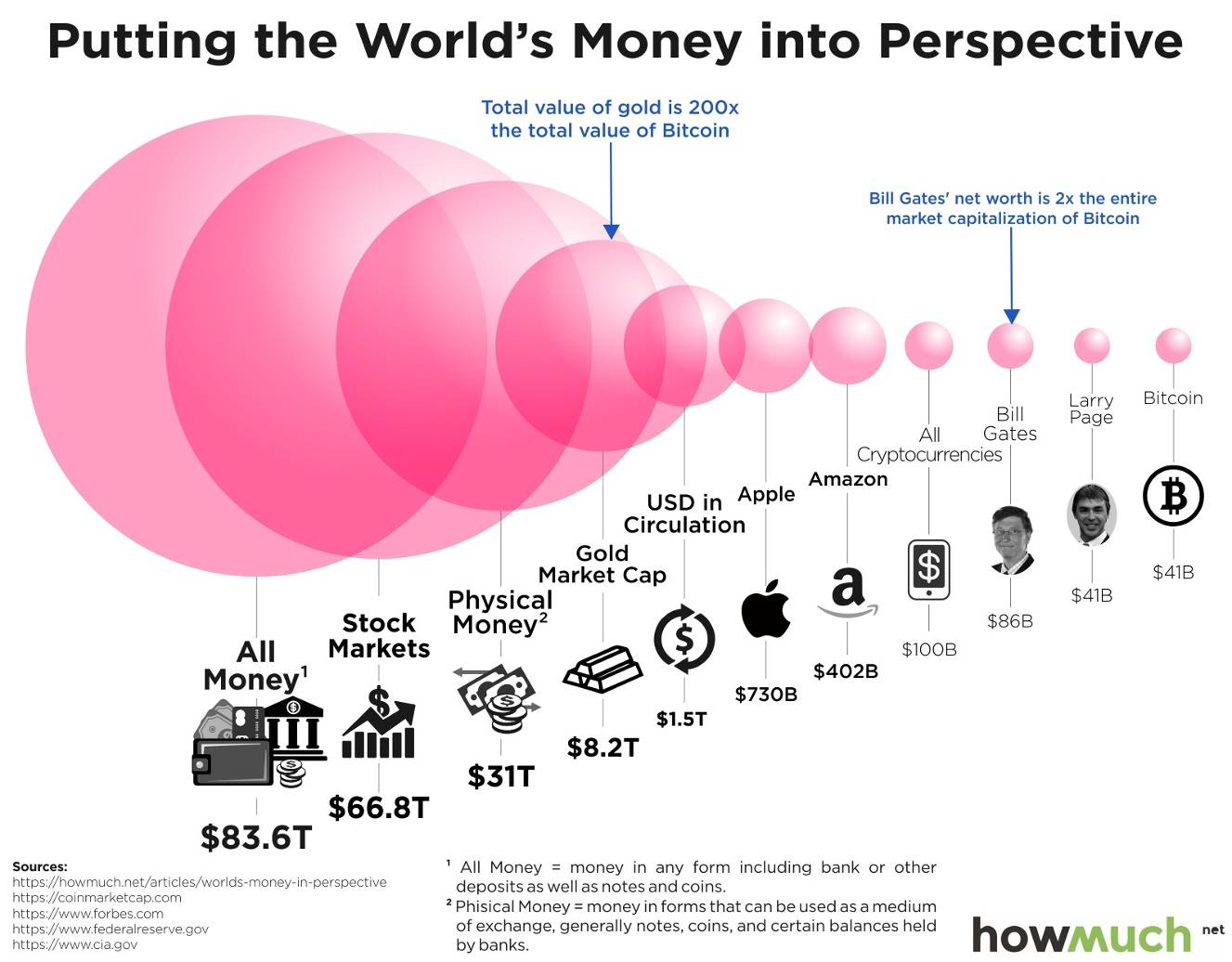

For centuries, Evolution of Investing & Asset Management methodologies and infrastructure have evolved in its various forms and nuances, but with the recent global changes within the Finance sector, along with the latest wave of Technological Revolutions, the age-old model has become antiquated and inefficient. In particular, since the Global Financial Crisis (GFC or “Lehman-Crisis”), the Financial Industry and the underlying system governing it has become even more ineffectual, with its purpose of serving the investment community of clients rapidly becoming redundant due to constrictive government policies and tightening regulations, global geopolitical and macroeconomic uncertainties, and overall reduction of the legacy finance professional talent pool (either due merely to cost-cutting labor-attrition processes or rather, the competitive-poaching from other industry sectors such as the Technology-intensive companies). Moreover, the Global Investment Culture has changed drastically over the past decade, in line with technological advancements, leading to both “New Styles” of Investing and “New Players” within the traditional Investment Community. To “manually” cater to such an extensive variety of ever-changing audience with diverse backgrounds and motley financial tastes/risk-appetites would be an almost impossible feat to say the least. Adding to the myriad of issues, the non-conducive global financial regulatory environment & unavailing policy changes has led to Financial Intermediaries no longer being the “value-added” service so touted in the past for the majority of Investors in general, due to the misaligned interests of the finance professionals at inception and the resultant mismatch in expectations by the clientele base. This has been painfully apparent in the global data statistics tracking consistent money-flow transitioning from “Active” to “Passive” Financial Management via ETFs, as well as the meteoric uprises of HFT [High-Frequency Trading] & A.I. [Artificial Intelligence] Funds.

In the effort and endeavor to resolve this global quandary and re-deliver “Value” back into the hands of the general public and average mass-market investor in a decentralized & distributed fashion, thus came the genesis of ATPHIZYOM by our Founder, Adam Tso, with its sole leading purpose of “Autonomizing” professional financial analytic knowledge from “Wall Street” via Artificial Intelligence [A.I.] techniques and methodologies, and providing it as an interactive A.I.-Blockchain-driven Software-as-a-Service [AIBSaaS] and Decentralized-&-Distributed-Technology to “Main Street”, thereby autonomously promulgating professional-caliber financial skill-sets to the general mass-market public. Through this process, ATPHIZYOM aims to create a globally digitalized “Symposium” for the mutual exchange of Advice & Ideas amongst the general population in order to accomplish the ATPHIZYOM 3-I’s: “Interconnection, Interaction & Interrelation”

Ultimately, ATPHIZYOM’s goal & mission is to revolutionize the personal lifecycle of financial investment management and help re-balance the global scales of Financial Inequality by creating and disseminating a scalable, commercially viable and affordable high-caliber financial analytical platform solution to a broad-based global audience that is able to “Scientifically Empower the Art of Investment” for the general population. Moreover, the “Open-Autonomy” nature and “Multi-Asset / Multi-Strategy Investing” aspect of the ATPHIZYOM Platform, by definition, caters to the ever-growing global list of diverse Investor Genres, ranging from the traditional archetypes such as Institutional Investors and Investment Professionals (e.g. Investment Bankers / Broker-Dealers & Traders / Asset Managers / Money Managers / Financial Planners-Advisors), all the way to the other end of the spectrum being the average “non-professional” White/Blue-Collar Workers, Private Investors, High/Ultra-High Net Worth Individuals (HNWI / UHNWI), Youth & “Millennials”, Retirees/Pensioners, Amateur Investors and Investment Aficionados.

The all-encompassing ATPHIZYOM platform offers both “Diversity” and “Diversification” in terms of the multitudinous facets of Investment & Asset Management, whilst consolidating the entirety of the complex algorithmic solution into one simple and convenient interactive interface for users of all calibers to access, personalize and expedite instantaneously their individually customized financial investment management lifecycles on a daily basis. By nature of the financial business and industry practice, “Mismatch” of expectations and realized outcome (“Actual” financial performance & investment returns) between Investors (Clients) and BOTH Sell-side (Brokers, Financial Intermediaries, etc.) & Buy-side (Asset Managers, Money Managers, etc.) institutions will always exist and persist due to inherent human bias-perception. Hence, to resolve this discrepancy in expectations, the ATPHIZYOM Platform solution utilizes the innate “customization” nature/aspect of the autonomous investment & asset management mechanism built into the platform to “Align” investor (platform-user) expectations DIRECTLY with their own individual financial performances.